The Great Wealth Transfer: Unlocking Opportunities for Future Generations

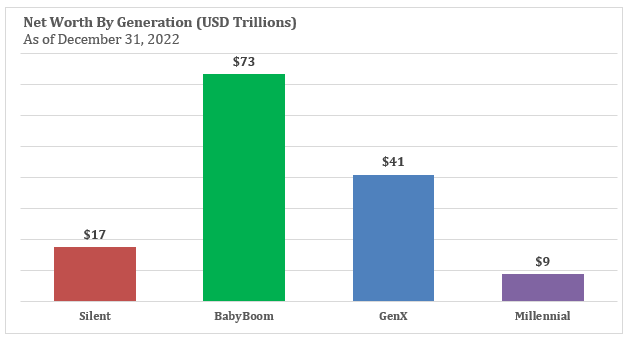

It has been dubbed the Great Wealth Transfer. The media and financial industry have been abuzz about it for quite some time, and with good reason. Over the coming years, trillions (emphasis on that t) of dollars will be passed down from one generation to another. The exact dollar amount is difficult to pinpoint since asset values fluctuate over time, but the combined wealth of the Silent Generation and Baby Boomers at the end of 2022 was roughly 90 trillion USD.1

Generations by year:

Silent Generation Born Before 1946

Baby Boomers: 1946-1964

Gen X: 1965-1979

Millennials:1980 – 1994

Boomers Have Begun Passing Down Their Enormous Wealth

Sources: Federal Reserve, Survey of Consumer Finances and Financial Accounts of the United States. Data as of 12/31/22. Most recent data available.

Most of the assets transferred are expected to go from Baby Boomers—whose population size and wealth are considerable—to Gen Xers. Millennials are expected to be beneficiaries as well, just not quite to the same extent—at least not yet.

Understanding the Great Wealth Transfer

While all the hype around the Great Wealth Transfer is certainly justifiable, given the size of the shift in wealth and the opportunities that are likely to be created, it is important to remember that we are not talking about a single event or point in time. In fact, when you remove the fancy, mildly hyperbolic label, we are just talking about older generations preparing to care for younger ones (including maximizing the assets passed down to loved ones while limiting estate taxes). This is something we humans have been doing since time immemorial.

Most wealth management firms would likely have been preparing you and your family for such events as a foundational part of their service offerings and not necessarily because of some seismic shift in assets.

Even so, you can use the attention the Great Wealth Transfer has garnered as a catalyst to start (or continue) to plan. Involve your loved ones to the extent you deem suitable. Use your adviser to mediate important family meetings. If you are not comfortable divulging dollar amounts, you do not need to. You can cover a lot of significant territory as a family without getting into the specifics.

This is an opportunity to have meaningful, educational, and hopefully rewarding conversations with your loved ones about the opportunities and responsibilities that come with wealth—including their roles as stewards.

Most people think family discussions around wealth will create anxiety—but often, the opposite happens. It alleviates it.

Preparing for the Future: A Comprehensive Approach

Preparing for the future is about more than just money. None of us knows what the future will bring, and that uncertainty can breed worry. Parents worry about their children. Children worry about their parents. While we cannot predict the future, we can certainly plan for many possible scenarios. We can prepare for the things that are likely to happen, even if the details and timing are murky. We can also do some contingency planning for those proverbial curveballs that life throws our way. Aside from giving you and your family much-needed peace of mind, having a comprehensive plan in place allows you to wrest control back from fate, and fate is not a good fiduciary.

Below are four tips to help you better prepare.

1. Seek professional guidance

Even the most financially savvy need advice. A financial or wealth adviser can help with much more than investment advice. They can assist you with setting financial goals and strategies based on your and your family’s needs. They can help you save for retirement and college, set up trusts, handle difficult tax situations, navigate new tax laws, and address inflation and interest rate concerns.

When our finances and families grow, they become more complicated—and even more so when they intersect. These situations create blind spots and pitfalls. A financial adviser can help facilitate essential family meetings as well as identify the right people to involve and what roles they might have. They can also help teach younger generations about wealth in ways that help ensure it acts as a positive influence.

You can use your financial adviser’s depth and breadth of experience to help guide you through different market cycles and life events.

2. Develop a robust wealth management strategy that includes other generations

A wealth management strategy does not have to be overly complicated, but it should address very fundamental (and sometimes aspirational) elements of your financial life, such as goals (and your plan to reach them), budget, estate plan, investments, real estate, savings, pension, life insurance, and debt. Your strategy should be a flexible, living document that is revisited periodically since it will likely need to be amended over time.

Estate planning

The most vital piece of an estate plan is typically a will, but an estate plan is often much broader. An estate plan could also include trusts to help protect future generations’ wealth from creditors, divorce, or even themselves. It could also include advanced healthcare directives and long-term care provisions so your family knows how to take care of you if your mental or physical health deteriorate.

Investment planning

A good investment plan is more than just a list of the stocks, bonds, and other assets you might own. Sure, financial planning involves your portfolio, but it is more than that. It is a personalized guide to how you are going to reach your financial goals, given where you are today. It considers your time horizon and makes sure you are adequately diversified. It knows your family, income needs, budget, and risk tolerance. It also keeps taxes in mind.

Risk management

Risk management is a critical component of overall wealth management because risk itself is often the forebearer of return. Their symbiotic relationship means you cannot have one without the other. It is almost always a trade-off. However, you can be smart—and intentional—about the risks you take. You can try to identify, analyze, and hopefully mitigate any unnecessary risk. You can set parameters or guardrails to minimize human errors (such as when emotion tends to overpower reason). Because the future is uncertain and markets can be volatile, a good, comprehensive wealth management strategy involves a great deal of risk management.

3. Embrace technological advances

The technological progress taking place in the financial services industry is nothing short of stunning. Investors of all shapes and sizes now have relatively easy access to a whole host of tools and platforms to help manage their finances. While we encourage the embrace of technology, the tools and platforms you use should serve to further your financial goals, not add unnecessary complexity. If you’re ever in doubt, this is another area to seek advice.

Digital financial tools

Most of us already use digital financial tools, even if we do not consciously realize it. They often facilitate how we pay bills, transfer money, and check our investment and retirement accounts. There are also great tools that help do many other things like managing spending, saving, budgeting, credit, and debt.

Collaborative platforms

Collaborative platforms, as the name suggests, allow you to collaborate with others without the need for proximity. This could be with your financial adviser, but it could also include an attorney, trustee, family member, or anyone you trust. You can accomplish all sorts of things from the comfort of your home or office. You can schedule a meeting over video, instant message a question, jointly browse and discuss your goals, and review and sign documents.

4. Foster financial literacy

Knowledge is power. So said Sir Francis Bacon more than 400 years ago. It is no less true today and certainly no less true as it pertains to financial acumen. For such a critical part of our lives and livelihoods, our traditional education system is woefully inadequate.

Fostering financial literacy with your loved ones is a wonderful way to bridge the gap and ensure multiple generations gain both the confidence and competence they need to manage their financial health and well-being.

Experience is the most generous teacher

There is no substitute for hands-on experience. Your financial adviser can help you set up custodial accounts and/or small dollar gift amounts to help train younger generations to handle wealth. Plans can be adjusted on the fly.

Educational programs

There are plenty of good online educational programs—regardless of age or skill level. They are offered by an array of institutions—government agencies, banks and credit unions, trade associations, universities, non-profits, and for-profits.

Howland Capital—Focused on Family from the Very Beginning

Howland Capital was founded by the Howland family more than 50 years ago with the express purpose of managing family wealth. Viewing wealth from the lens of a family—and managing it across multiple generations — is at the heart of what we do and has been since our inception. We pride ourselves on developing relationships built on trust that span multiple generations.

Any successful wealth management plan, in our view, requires four things—time, knowledge, interest, and discipline. Most people have one, two, or even three of these attributes. Hardly anyone has all four. That is one of the reasons wealth has such an abysmal record of surviving successive generations. That is also where Howland Capital can be your greatest ally. Intergenerational wealth planning and management is our expertise. We can help round out your skillset and put together a solid plan for you and your family—one that is designed to last for generations.