After a strong and steady economic recovery from the pandemic-led downturn in 2020, 2022 has been a year of uneven growth and rising uncertainty. After contracting 1.6% and 0.6% in the first two quarters, real GDP (i.e. economic output adjusted for inflation) grew at 3.2% in the third quarter of the year. Growth in the third quarter was buoyed by an especially large contribution from net exports (the value of exports less imports), which is not likely to be a sustainable contributor to economic growth going forward. The outlook for growth looks weaker for the next few quarters; the real tightrope walk begins as the year unfolds as the risk of negative GDP growth, and therefore a recession, picks up.

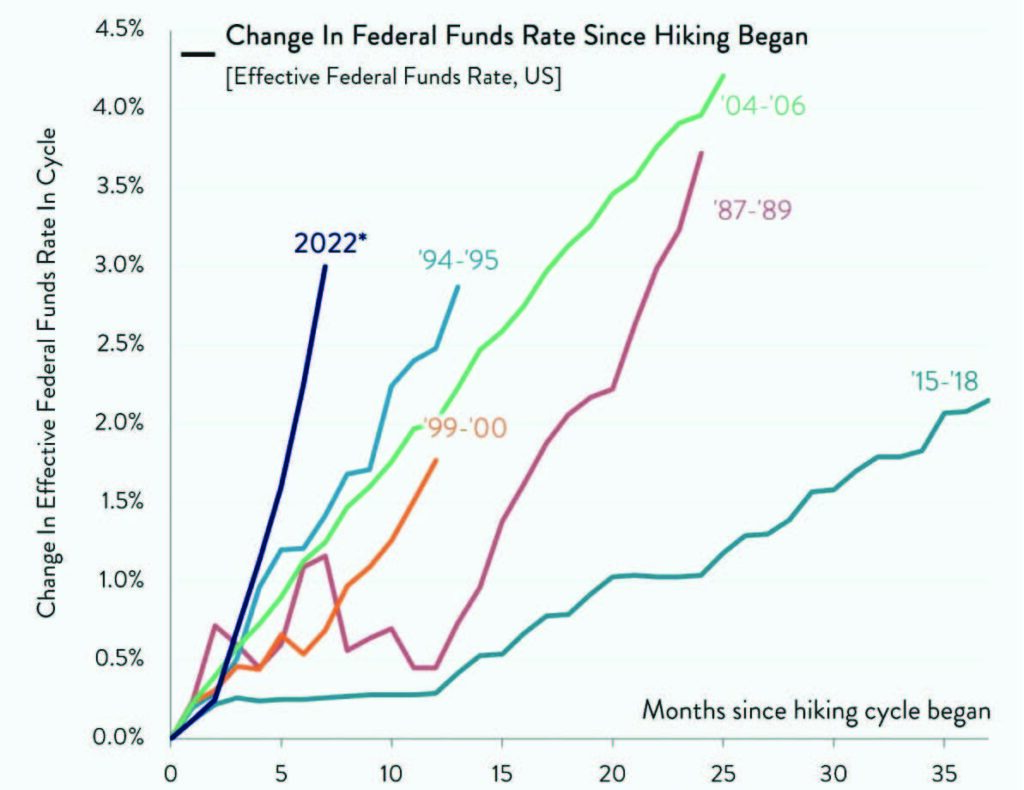

The greatest headwind to economic growth is Federal Reserve policy. As 2022 progressed, the Fed realized its previously held view – that inflation trends would be transitory – was clearly not correct. Shifting course, the Fed pivoted toward much more restrictive monetary policy, hiking interest rates at an increasingly faster pace. In December, the Fed brought the target short-term policy rate to 4.5%, up from 0.25% at the start of the year. Furthermore, it signaled it is not done yet by forecasting a median of 5.1% in the policy rate by early this year. The Fed also guided that once it is finished hiking, rates will likely remain higher for a considerable period until inflation declines towards its long-run 2% target. The impact of such a steep rise in rates is hard to overstate, as it ripples through almost borrowing costs lead to falling demand, especially for big ticket items like autos and home purchases. Mortgage rates have more than doubled since the start of the year, contributing to declines in home building, home sales and broader consumer spending.

The Fed is Hiking Further & Faster Than At Any Time In Modern History

The sharp rise in interest rates orchestrated by the Fed is focused on a singular threat to economic growth – inflation. For the first ten months of 2022, the headline consumer price index (CPI) increased at an annual rate of 7.7%, while the core CPI (which excludes food and energy) increased at an annual rate of 6.2%. Both measures are expected to slow sharply in 2023 to about 3.5% according to the Fed. Wage growth was also strong in 2022, as the job market remained robust. The unemployment rate in November was 3.7%, which is historically low. While the economy added about 4.1 million jobs through November, the pace of job creation has slowed. Even as wage pressures ease, the outlook for broad inflation remains highly uncertain and most forecasters (both professionals and policymakers) have underestimated the trend in inflation over the past year. As a result, the Fed is likely to stay on its current path toward higher interest rates and keep the risk to economic growth elevated in the year ahead.